Financial Balance - What’s your Money Dynamic?

Do you think about money? Or do you just use money as you need it? How does your mind and body respond to money? What If we were to think of money as a person. Where would you put money in your interaction circle? It may seem like I’m asking you questions that make very little sense but read on to understand this hopefully interesting breakthrough I’ve had in how we all deal with money in our unique ways.

Your attachment style

Psychology classifies the way we attach to people into four types. If you’re securely attached, you’re comfortable with closeness and independence. You trust easily, communicate openly and manage conflict well. If you’re anxiously attached, its likely you crave closeness but fear abandonment. You overthink, needs constant reassurance, can be clingy. Those that are avoidantly attached tend to value independence, avoid emotional vulnerability and can feel smothered and often shuts down in conflict. Finally, people with disorganized attachment are unique in their conflicted, unpredictable behavior patterns where they desire intimacy, but fear hurt. A lot of times people can be a mix of more than one style. Why does this matter? Because if at your core your physiology and biology is trained to interact in a certain way, it’s inevitable that this tendency will spill over to other aspects – even money

The interaction circle

Think of yourself as the center of concentric circles. The smallest circle has those closest to you – probably your best friends, your partner, children etc. As people move to outer rings, their influence on your life becomes lesser. Now, think of money as a person and think where you would place it today. While thinking about this, also think about your core attachment style i.e. are you secure, anxious, avoidant, disorganized or, a mix of some of the above. Let me explain.

Your money persona

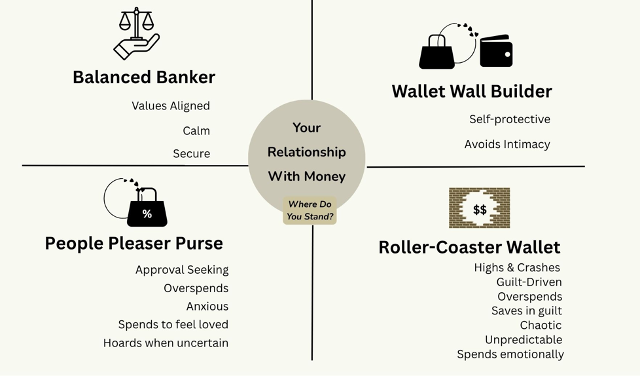

When you think about the above, what’s your dynamic with money? Are you a Balanced Banker where your values and money align, you are mindful and open with money and make calm, considered choices? Money is a tool for you, and you know how to use it. It may pose challenges, but it does not cause stress. Like secure attachment, this is a goal and a space most people want to find themselves. But the reality is we mostly exhibit a mix of the other dynamics. You could be a “People Pleaser Purse” i.e. you spend to gain love or approval. Might overspend to fit in and you probably hoard money when feeling unsafe. This is in sync with a typically anxious person. Alternatively, you could be a “Wallet Wall Builder” where you keep tight control over money, avoid joint decisions and shut down financial vulnerability. This aligns with an avoidance attachment style where independence is valued above all else, being smothered is unbearable and shut down during conflict is a norm. Finally, you could be a “Rollercoaster Wallet”- unpredictable with binge-spending during emotional highs and swift swings to guilt or extreme saving. If this is you, it’s a disorganized attachment style and where actions are conflicted, unpredictable and often trauma shaped.

What do you do with this?Know that money is just another relationship in your life. Yes, it’s a means to living a life but it’s a very complicated means – one that is very layered in our innate patterns. How do you improve this relationship? The same way you do others – you work on it. You figure out patterns and you think about your money mindset. As you become aware, out of your next 10 money decisions, perhaps in one you will think again because you recognize a pattern based on what you’ve read here. That’s the first step. the ability to be objective and balanced with money is a skill. Like all skills, it can be learned, practiced and built into your muscle memory in a way that you choose. Stop fearing, start noticing – the skill will follow.

*All terms coined here are original expressions are the intellectual property of the author. Unauthorized use or reproduction is not permitted.

Written for and published in Bahrain This Month